What is Accounting Structure

FoundryBean Global Work System is designed to make sure your organization can meet legal and organization objectives in a single system in a global workplace. Though varies from organization to organization , accounting structure is determined based on industry , location, business and accounting policies , business requirement and functions performed by the business. Business also wants to track and manage various cost centers and departments across the organization. In an Organization with multiple companies or subsidiaries , Management may want to segregate the accounting data into different division to measure and report financial performance . Merger and acquisition arise unique situation where the incumbent company has a different accounting structure and legal requirement than the parent company .

🛎️

FoundryBean Global Work System Accounting structure gives the organization the ability to showcase various accounting structure in a single company .

What drives Accounting Structure

Legal Entity Structure

Legal entity is any company or organization that has the legal right and responsibility to do business in a country or location. There are different types of legal entities exists such as sole proprietorships , partnerships, non-profits ,corporations and government entities . Organization need to follow applicable rules and regulations surrounding the legal entity such as pay income and transaction taxes, process and collect value added taxes on behalf of tax authority, maintain statutory reporting and comply with legislations and regulations . Many large organizations reduce risk and optimize taxes by creating legal entity structure incorporating subsidiaries.

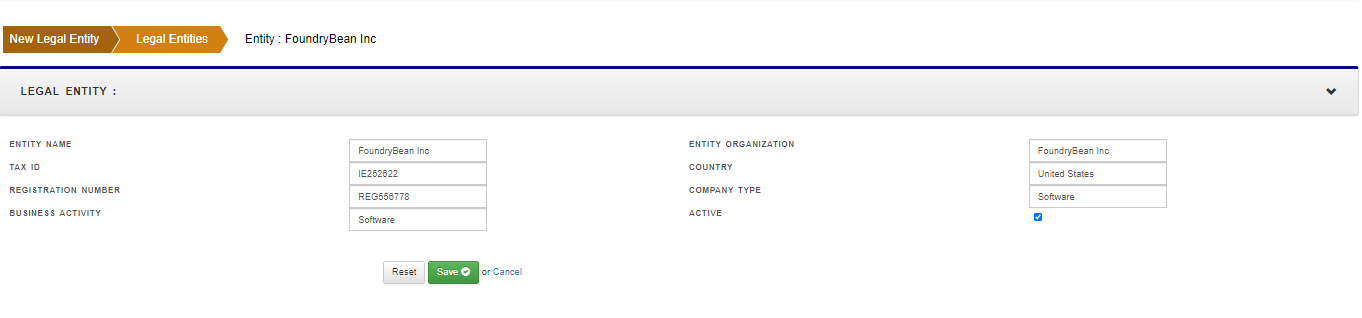

Though not a mandatory requirement to add Legal entity into FoundryBean Global Work system , it gives ability to maintain legal entities in the accounting system

Chart of accounts (COA) Structure

Chart of accounts (COA) is an index of all financials accounts of the company or subsidiary. Chart of account is an accounting structure of a company or a subsidiary to organize their finances and give interested parties ability to give insight to their financial health. Chart of accounts provides a framework for financial tracking and reporting. It is made up of the individual GL accounts to organize the business information such as your assets, liabilities, equity, income, and expenses and provide granular details of identifiable accounting information.

A company with multiple subsidiaries can have multiple chart of accounts .

In a consolidated financial statement , different chart of account structures are mapped in a meaningful way to aggregate the transactions.

Ledger

The accounting ledger provides a centralized repository of all account transactions in a particular period rolled up from subledgers or modules. You can have multiple ledgers for a company or a subsidiary . Each ledger can have only one accounting structure . Each ledger must have a predetermined COA structure , accounting calendar , ledger currency and accounting method.

Multinational companies generally have different ledger for each country due to statutory requirement to report and maintain financial statement in a particular ledger and reporting currency. More…

Security

FoundryBean Global Work System is designed to make sure your financial data are secured and separate from other structures within the same company or subsidiary. Each ledger data is separate from other ledgers and users need to have access to a particular ledger to access data.