Financial Statements

Financial statements are how companies communicate their story. Thanks to GAAP, there are four basic financial statements everyone must prepare . Together they represent the profitability and strength of a company. The financial statement that reflects a company’s profitability is the income statement. The statement of retained earnings – also called statement of owners equity shows the change in retained earnings between the beginning and end of a period (e.g. a month or a year). The balance sheet reflects a company’s solvency and financial position. The statement of cash flows shows the cash inflows and outflows for a company over a period of time.

There are several accounting activities that happen before financial statements are prepared. Financial statements are prepared in the following order:

Income Statement

Statement of Retained Earnings – also called Statement of Owners’ Equity

The Balance Sheet

The Statement of Cash Flows

Income Statement

The income statement, sometimes called an earnings statement or profit and loss statement, reports the profitability of a business organization for a stated period of time. In accounting, we measure profitability for a period, such as a month or year, by comparing the revenues earned with the expenses incurred to produce these revenues. This is the first financial statement prepared as you will need the information from this statement for the remaining statements. The income statement contains:

Revenues are the inflows of cash resulting from the sale of products or the rendering of services to customers. We measure revenues by the prices agreed on in the exchanges in which a business delivers goods or renders services.

Expenses are the costs incurred to produce revenues. Expenses are costs of doing business (typically identified as accounts ending in the word “expense”).

REVENUES – EXPENSES = NET INCOME. Net income is often called the earnings of the company. When expenses exceed revenues, the business has a net loss.

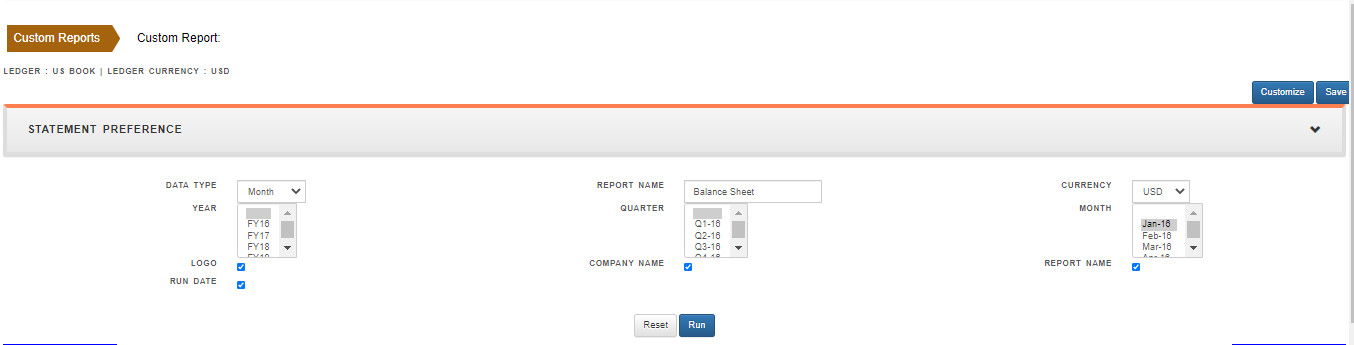

Balance Sheet

The balance sheet, lists the company’s assets, liabilities, and equity (including dollar amounts) as of a specific moment in time. That specific moment is the close of business on the date of the balance sheet. Notice how the heading of the balance sheet differs from the headings on the income statement and statement of retained earnings. A balance sheet is like a photograph; it captures the financial position of a company at a particular point in time. The other two statements are for a period of time.