Receivable Billing Period

Receivable Period is based on fiscal period and is the span of time covered by a set of financial statements. The period defines the time range over which business transactions are accumulated into financial statements and is needed by stake holders controls the transactions and costs incurred in a period.

For internal financial reporting, an accounting period is generally considered to be one month. A few firms compile financial information in four-week increments, so that they have 13 accounting periods per year. Whatever accounting period is used should be applied consistently over time.

If a set of financial statements cover the results of an entire year, then the accounting period is one year. If the accounting period is for a twelve month period ending on a date other than December 31, then the accounting period is called a fiscal year, as opposed to a calendar year. For example, a fiscal year ended June 30 spans the period from July 1 of the preceding year to June 30 of the current year. Ideally, the fiscal year should end on a date when business activity is at a low point, so that there are fewer assets and liabilities to audit.

Yet another variation on the accounting period is when a business has just been started, so that its first accounting period may only span a few days. For example, if a business begins on January 17, its first monthly accounting period will only cover the period from January 17 to January 31. The same concept applies to a business that has been terminated. For example, if a business were to be shut down on January 10, its final monthly accounting period would only cover the period from January 1 to January 10.

Foundry Bean Accounting Period

Foundry Bean Accounting Period satisfy all the requirements of financial reporting.Financial periods are based on actual start dates and end dates and it is upto the business to decide number of days in a fiscal period.

Foundry Bean Accounting Period is based on General Ledger period and all the subledgers derive the accounting period from General Ledger. So Sub-ledger periods are not entered in the system and rather kept a status (open , close) of fiscal period for the sub-ledger.

Entering Status of Receivables Accounting Period

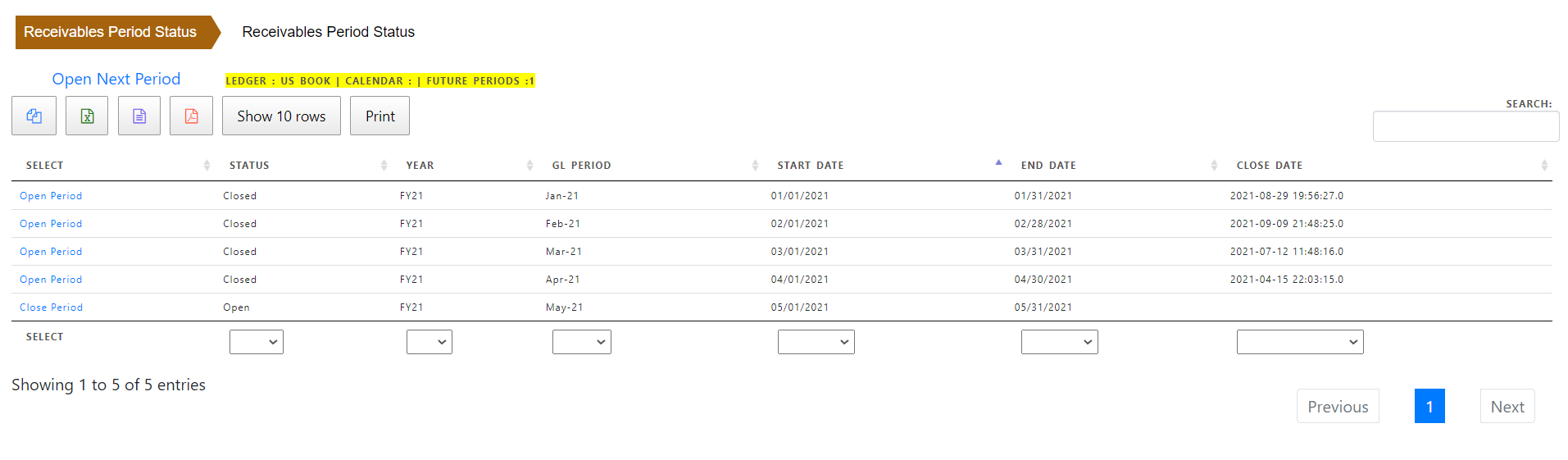

To see the status of Receivables Accounting Period , click AR Period and “Period Status” in AR Setup.

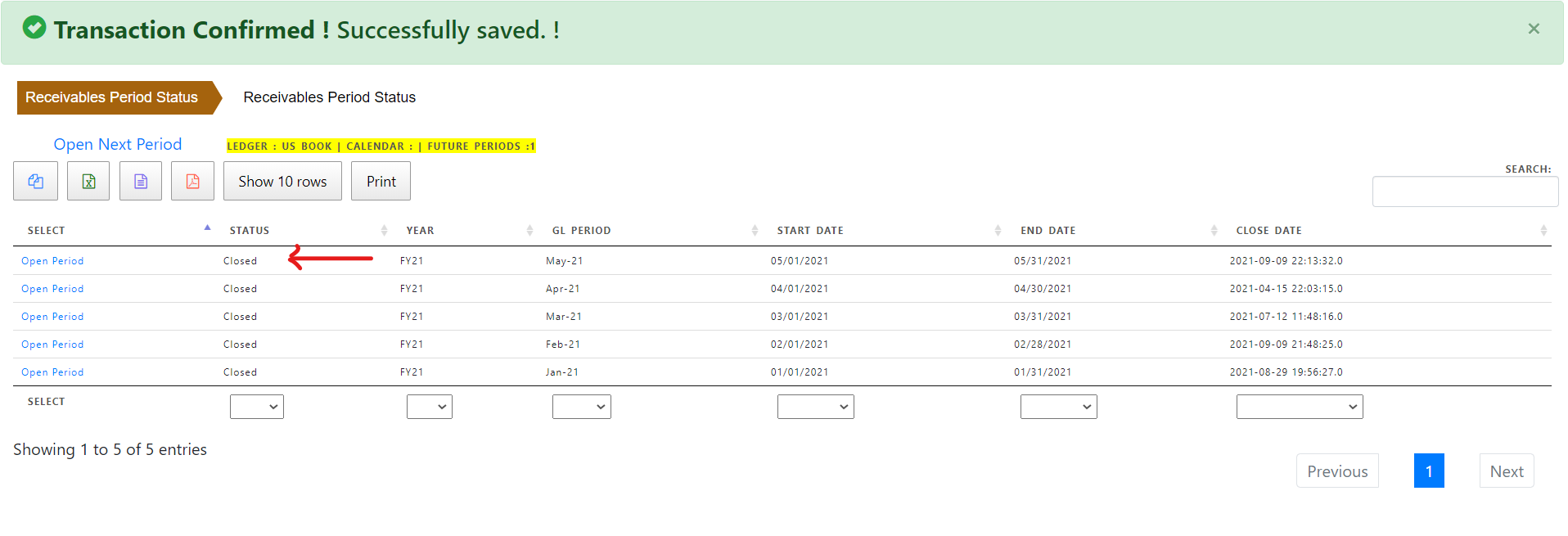

To close an accounting period , click “Close Period” in the period status line . The sub ledger period status must be “Open” to close the period.

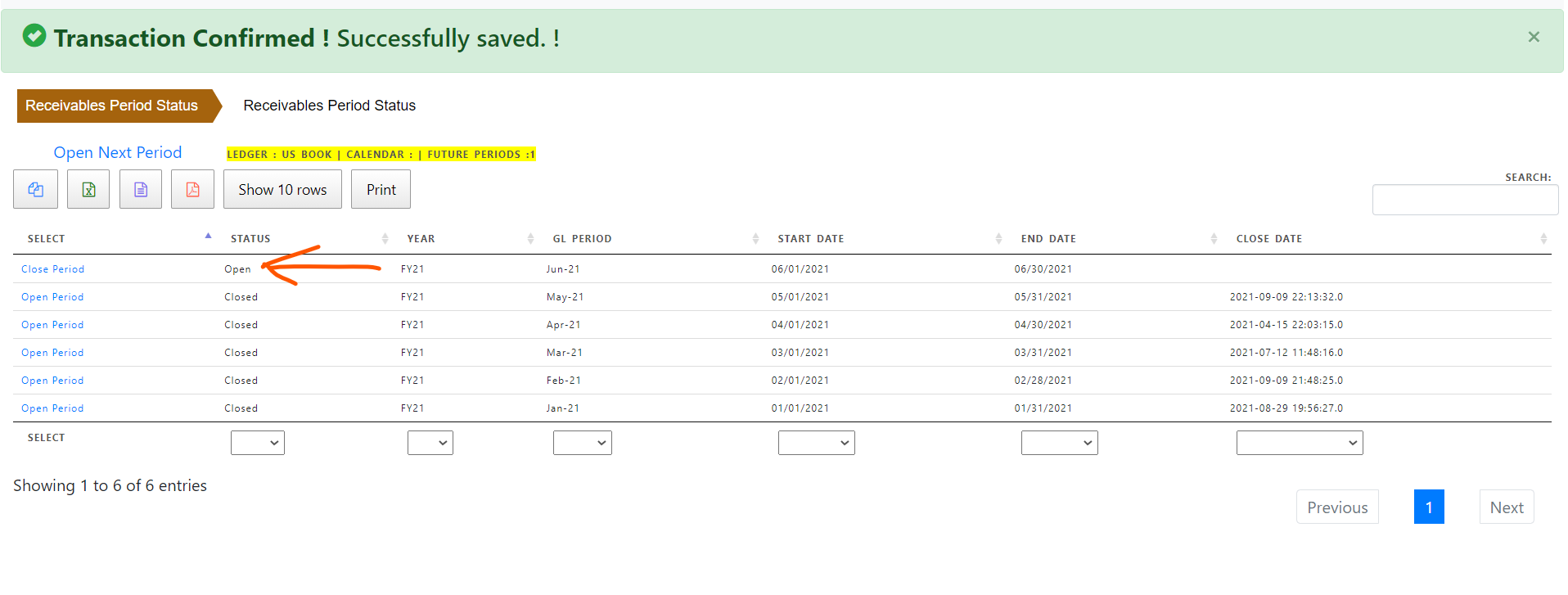

To Open Next Period , Click “Open Next Period” . System will enter a new accounting period line derived from general ledger period. The general ledger period must be defined and available to the sub-ledger. In this case , “Next Period” is not available in receivables but will be created automatically from General Ledger period and status will be “Open”.

To open a closed period , click “Open Period” in that period line.