Expense Types Setup

Expense types are expenses that an employee can incur such as airfair, lodging, business dining etc. These expense types are available to categorize an expense when the expense report is made.

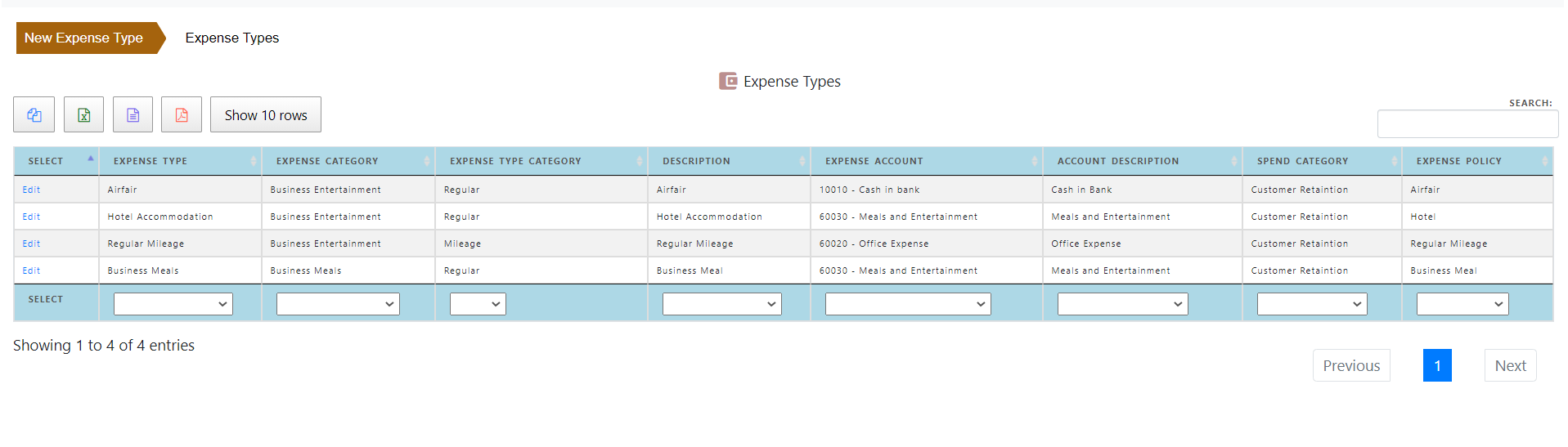

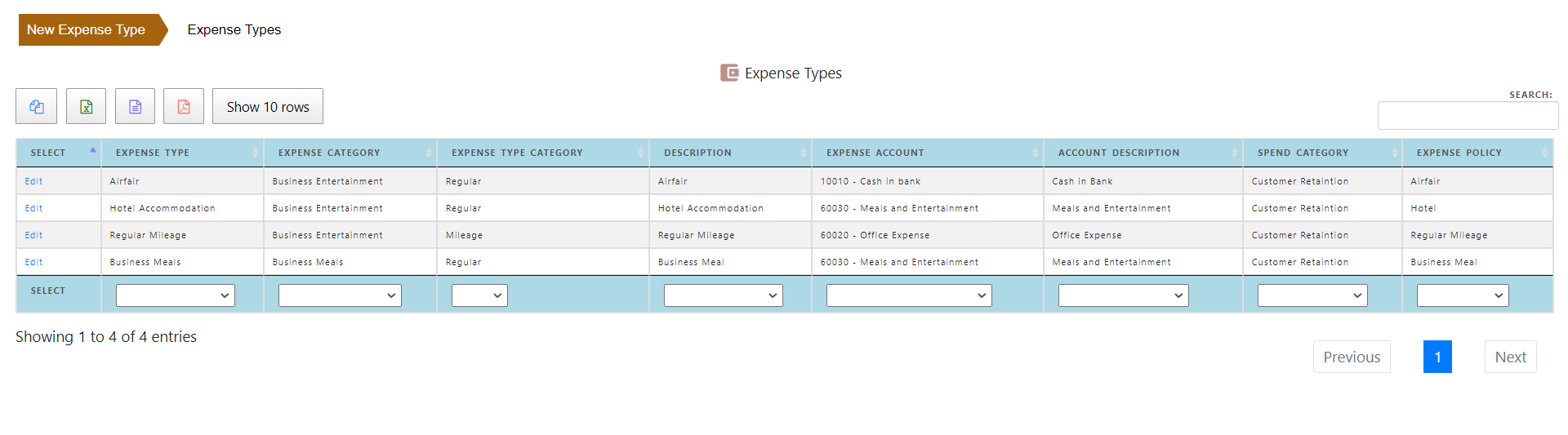

Find an expense type

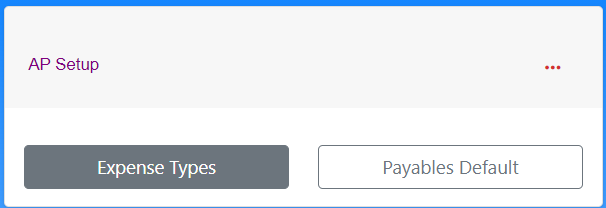

To see all the expense types , click “Expense Types” in AP setup.

You can search for an expense type to see if it is available.

To see the details of expense type , click “Edit” to see all the information for the expense type.

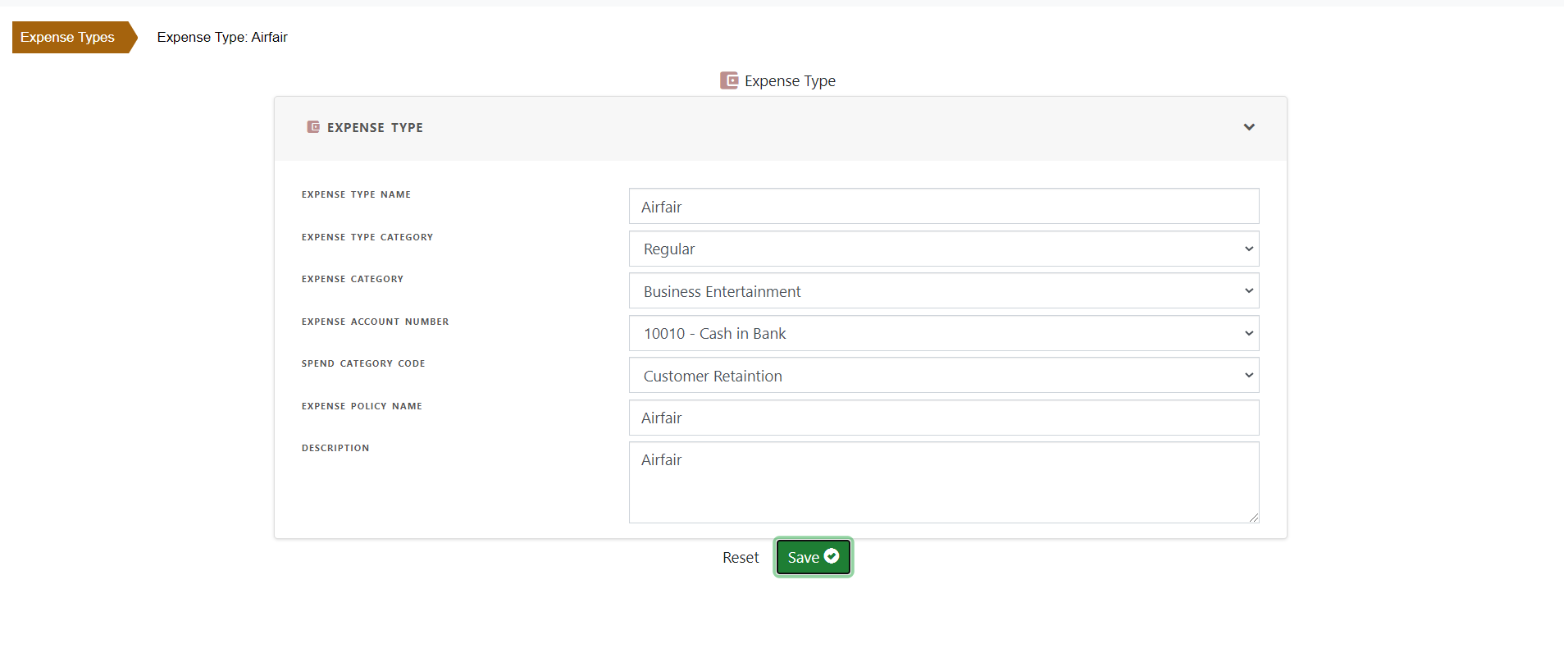

Edit an expense type

Click “Edit” to update an expense type.

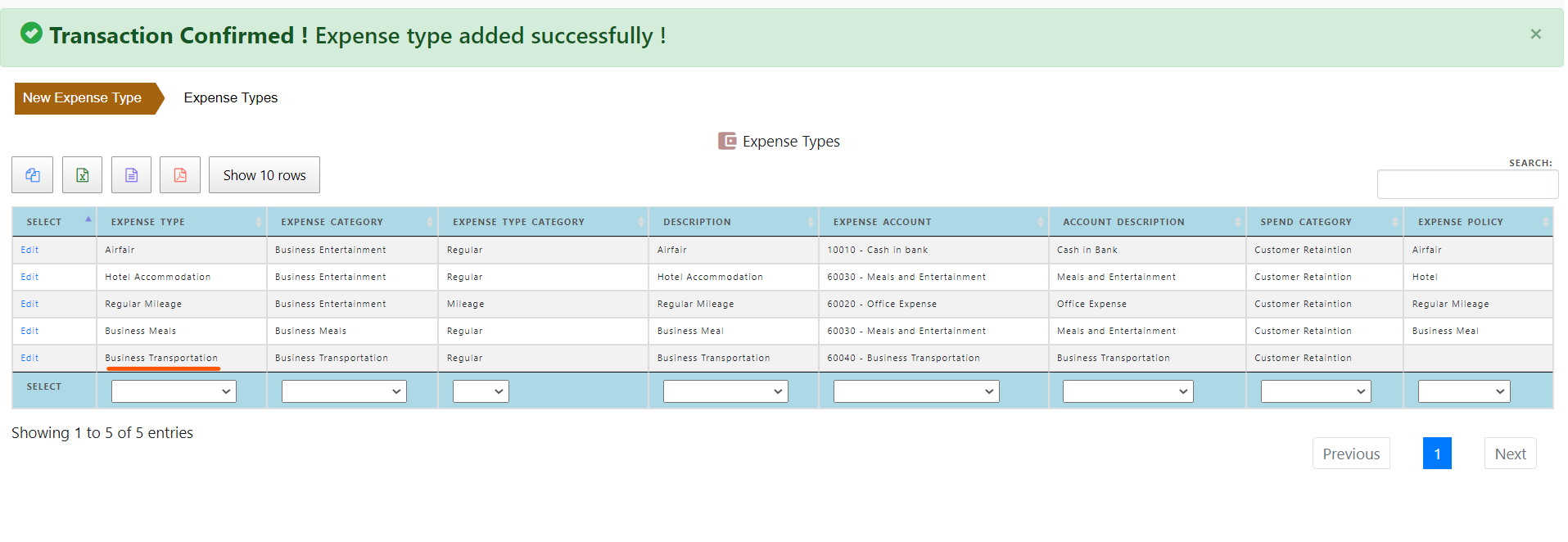

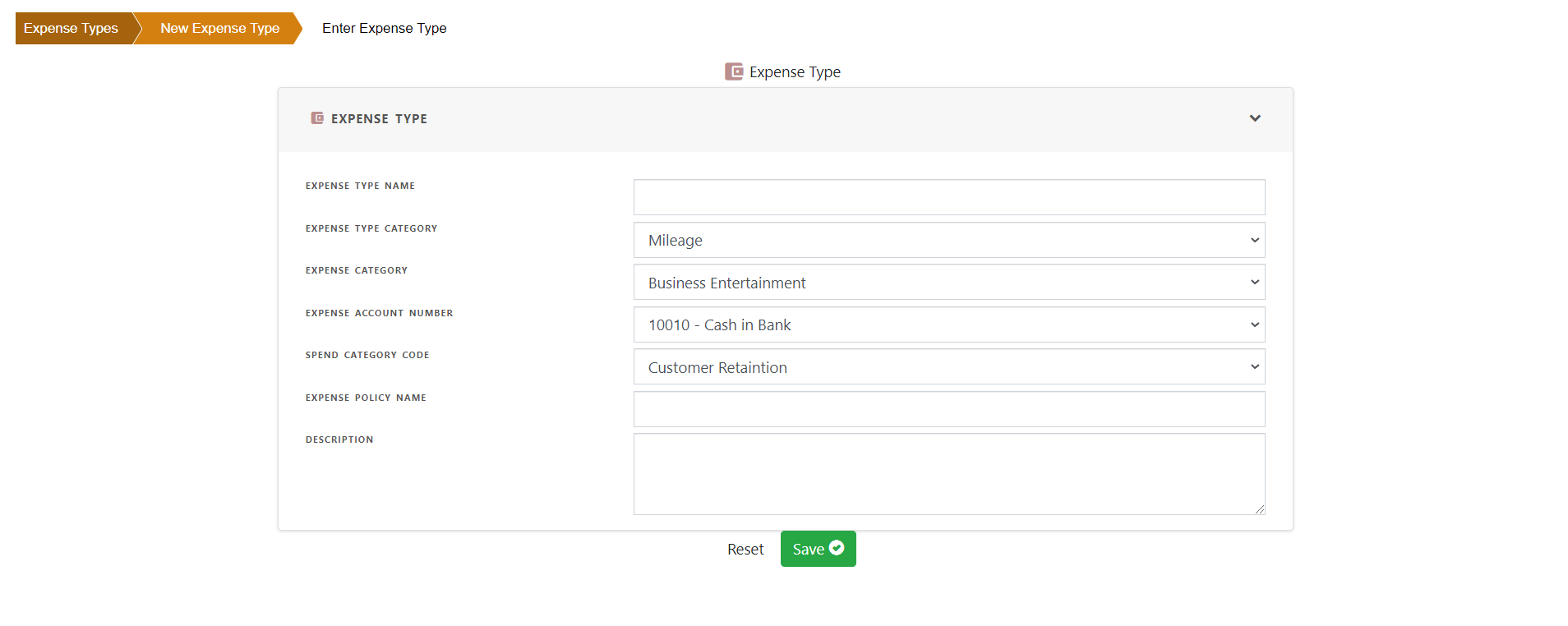

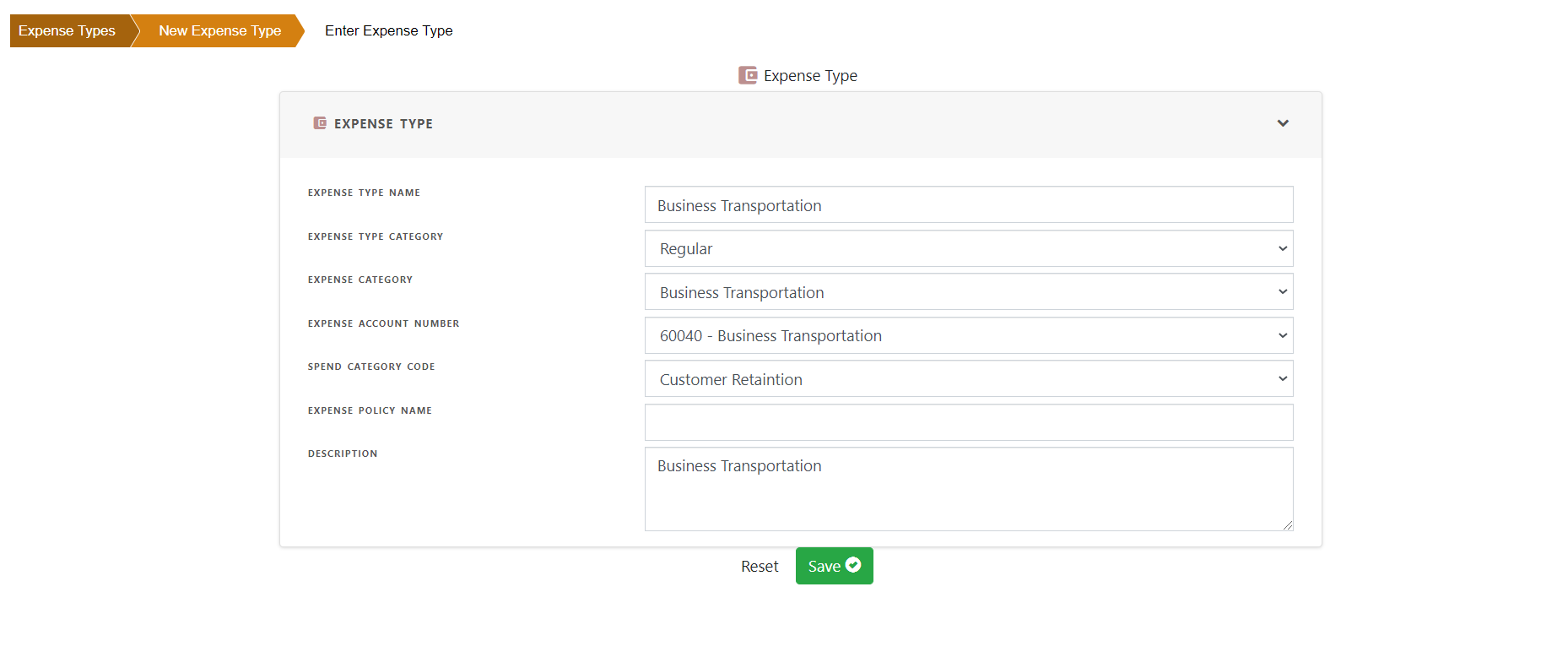

Create an expense type

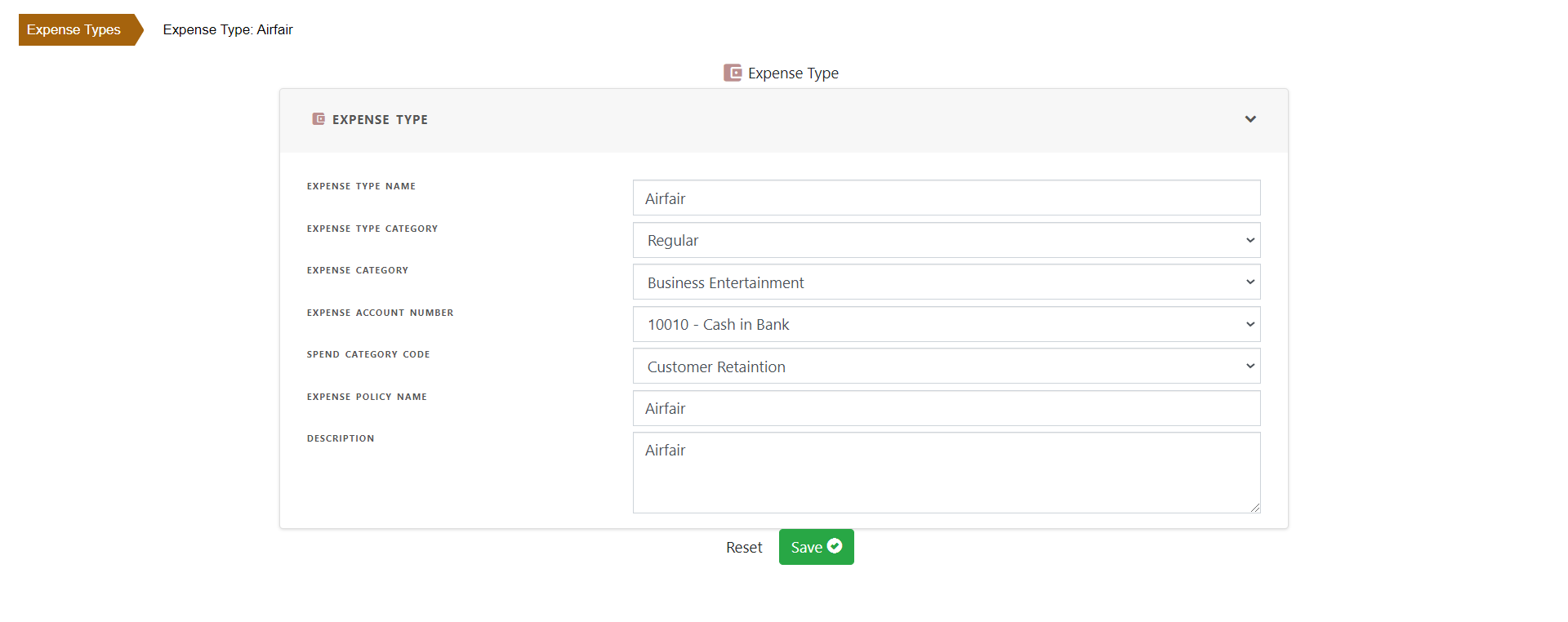

To create an expense type , click “New Expense Type”

Enter expense type name . This name will be available in expense report form while adding a expense.

Expense Type Category - either Regular, Mileage or Per Diem.

Mileage - Mileage category is used where expense is incurred related to vehicle travel. A mileage rate is predetermined and expense is calculated by Mileage rate * distance travelled.

Per Diem - This catrgory is used when is calculated based on per day rate rather than actual expense.

Regular - Regular category is based on the actual expense incurred by the employee. A Taxi fare, airfair , breakfast expenases are some relevant expenses fall under this category.

Expense categories are relevent to the expense policies of the company. For example , employee meals and accommodation costs can fall under Per Diem category if employee does not present individual expenses.

Choose Expense Category from the list os expense categories available in the system.

Expense Account Number - This account number will be used in expense report line containing this expense type.

Expense Policy Name - If the expense type is linked with expense policy , add the expense policy name. For example if there is any “AirFare” policy, airfare expense is linded with this policy .

Save the expense type.